Approfondimenti

Definition of formal violations

One of the initiatives introduced by the Budget Law 2023 (art. 1 co. 166 et seq. of Law 197/2022) is the regularisation of the formal violations committed until 31.10.2022. By the Provision no. 27629/2023 and with the Resolution no. 6 of 14 February 2023, were regulated the contents and methods of use of the "Regularization of formal violations" procedure.

This procedure gives taxpayers and also intermediaries to correct formal violations committed even in different tax periods, requesting the payment of an amount equal to Euro 200.00 for each tax period.

Objective aspect

With circular no. 77 / E of 3 August 2001, the Tax Authorities clarified that there are the following two types of formal violations:

|

Type Violation |

Description |

Sanctionable |

|

Formal violations |

They have not effect on the determination of the taxable amount, the tax and the payment of the tax, but they have an effect on the Tax audit activities. |

YES |

|

"Merely" formal violations |

They have not effect to the determination of the taxable amount, the tax and the tax and they have not effect on the Tax audit activities |

NO |

This regularisation is applicable only to formal violations, which are also the only violation sanctioned. Specifically, the following violations could benefit of the regularisation procedure:

- Formal violation until 31st October 2022;

- committed alternatively by the taxpayer, by the withholding agent, by the intermediary or by another person required to provide the tax fulfillments;

- for which the Tax Authorities are authorized to apply administrative sanctions;

- which have not effect on the determination of the tax base and the tax for the purposes of VAT, IRAP, income taxes, related supplements and substitute taxes, withholding taxes, tax credits and the related payment of taxes, but which they have effect on the Tax audit activities.

Following some example of formal violations that could be regularized, such as:

|

Sanction |

Definition |

Norm |

|

Declarations with errors |

Yes (circ. Tax Authorities of 27.1.2023 n. 2) |

Art. 8 co. 1 of Legislative Decree 471/97 |

|

Missed/irregular sending of periodic VAT settlements (LIPE) |

Yes if the tax has been correctly paid |

Art. 11 co. 2-ter of Legislative Decree 471/97 |

|

Invoice omitted or unfaithful (without effect on the VAT liquidation) |

Yes (circ. Tax Authorities of 27.1.2023 n. 2) |

Art. 6 co. 1 last sentence of Legislative Decree 471/97 |

|

Invoice omitted or unfaithful for exempt, non-taxable and excluded transactions (without impact on income tax) |

Yes (circ. Tax Authorities of 27.1.2023 n. 2) |

Art. 6 co. 2 of Legislative Decree 471/97 |

|

Yes (circ. Tax Authorities of 27.1.2023 n. 2) |

Art. 6 co. 6 of Legislative Decree 471/97 |

|

|

Omitted or irregular reverse charge |

Yes (circ. Tax Authorities of 27.1.2023 n. 2) |

Art. 6 co. 9-bis of Legislative Decree 471/97 |

|

Intrastat form |

Yes (circ. Tax Authorities of 27.1.2023 n. 2) |

Art. 11 co. 4 of Legislative Decree 471/97 |

|

Yes (circ. Tax Authorities of 27.1.2023 n. 2) |

Art. 10 of Legislative Decree 471/97 |

|

|

Irregularities in accounting |

Yes (circ. Tax Authorities of 27.1.2023 n. 2) |

Art. 9 of Legislative Decree 471/97 |

|

Declaration of beginning of activity, modification and termination |

Yes (circ. Tax Authorities of 27.1.2023 n. 2) |

Art. 5 of Legislative Decree 471/97 |

The regularisation is not applicable to:

- formal violation of tax rules concerning areas of taxation different of type mentioned above (e.g. formal violations relating to registration fee and succession duty);

- formal violations with a procedure definitively concluded on 1st January 2023;

- formal violations subject to a report pending on 1st January 2023 but in reference to which a final judicial decision has taken place or other forms of concession definition prior to the payment of the first instalment of the sum due for regularisation;

- acts of contestation or imposition of sanctions issued as part of voluntary disclosure, including documents issued following failure to complete the same procedure;

- violations of the RW framework (tax monitoring and violations related to the value tax of financial assets held abroad);

- omitted transmission of the Certifications.

Procedures for refining the regularisation procedure

Regularisation is completed by:

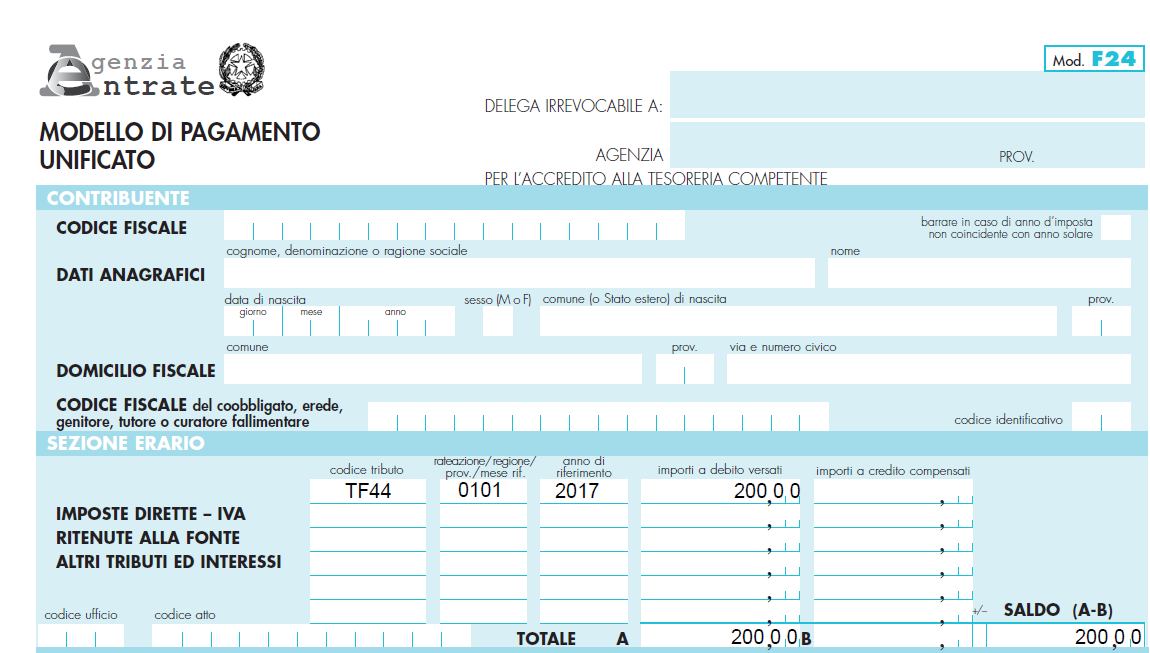

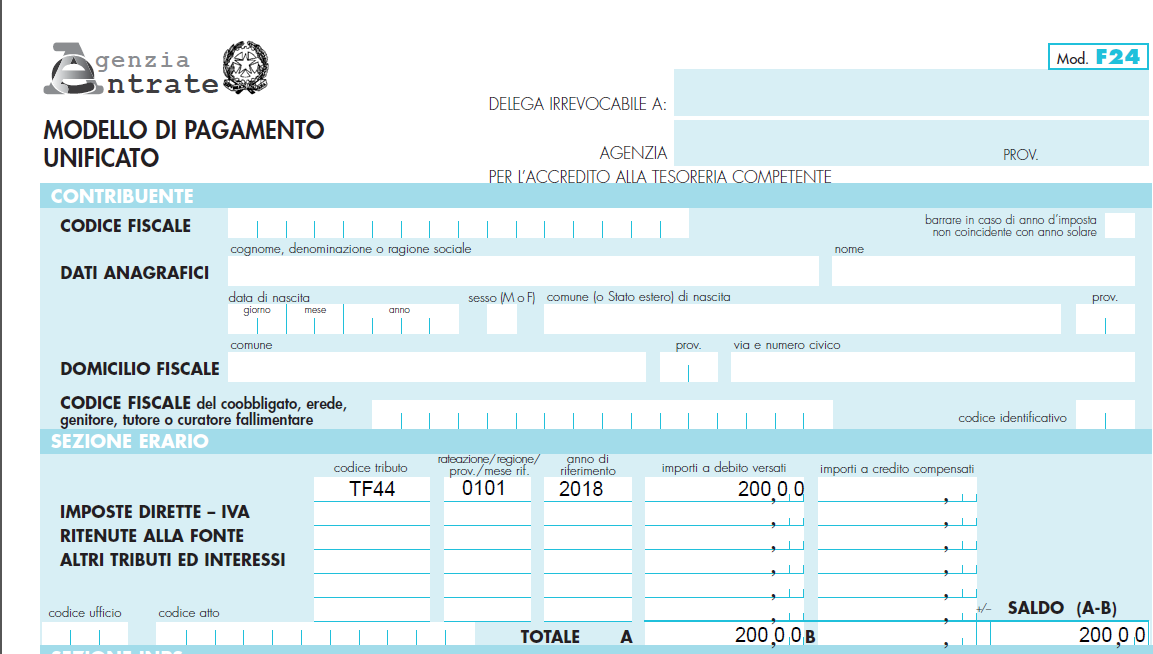

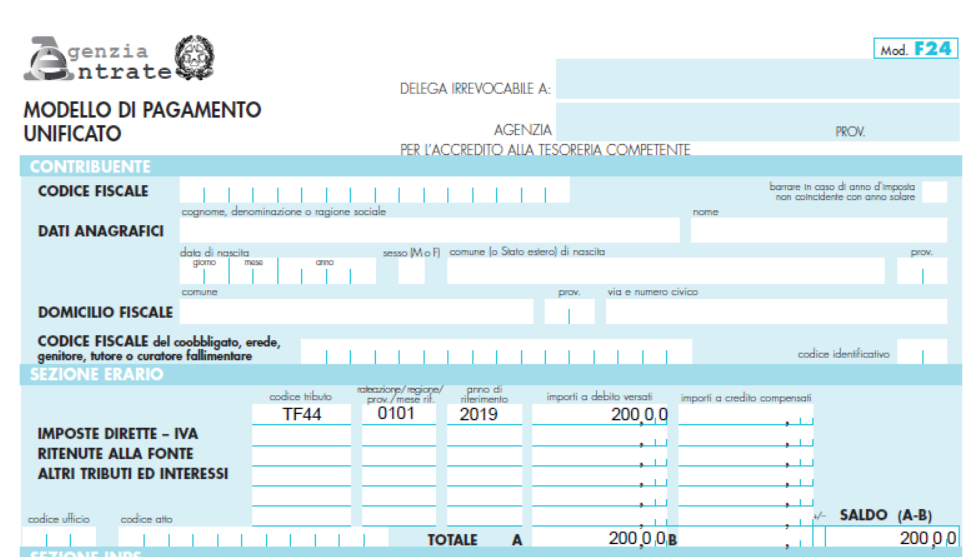

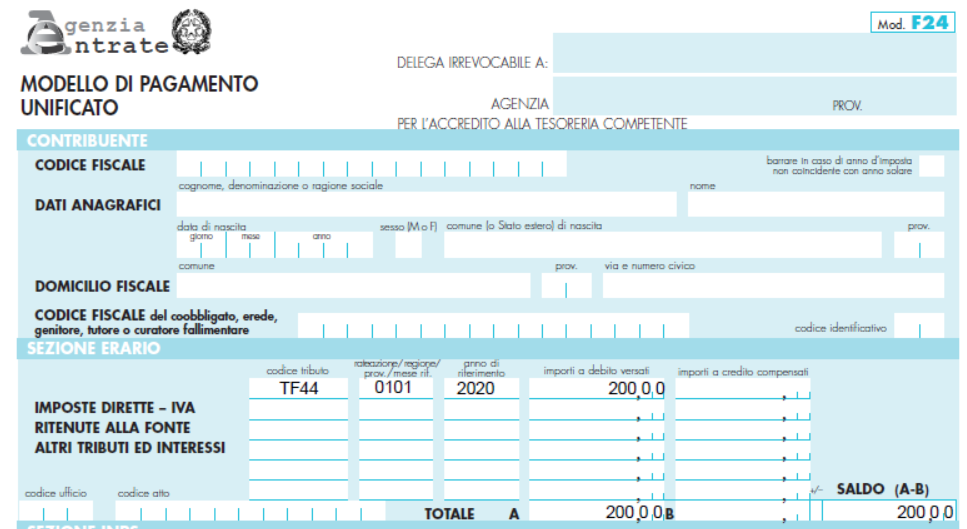

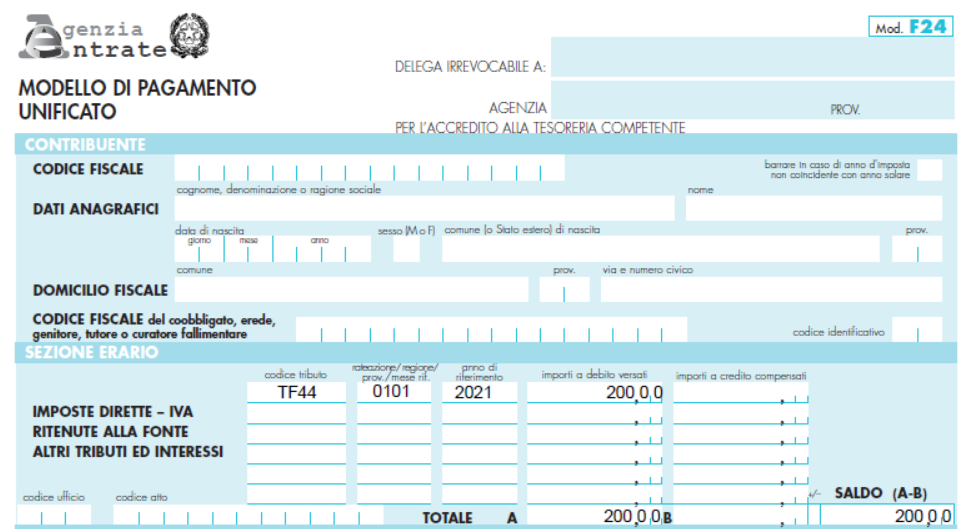

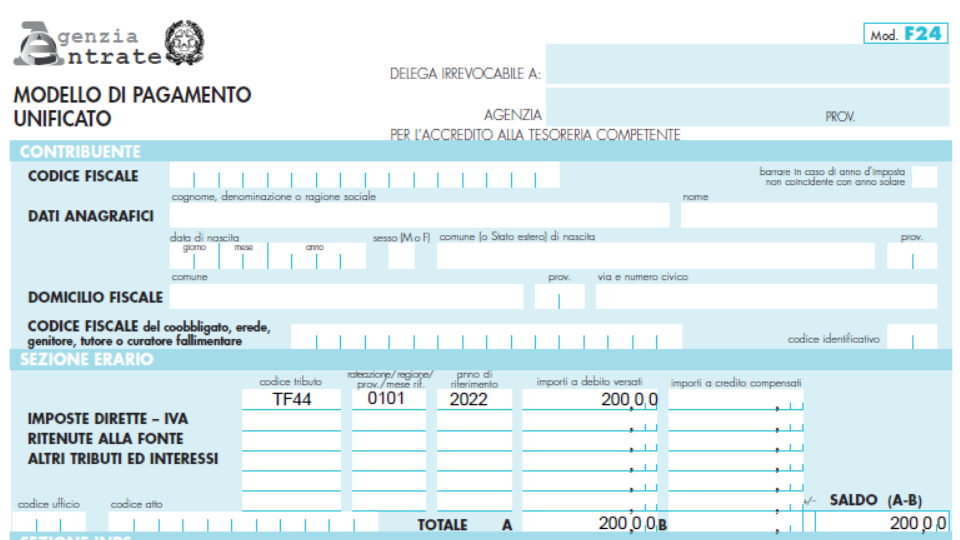

- the payment of 200 Euro for each tax periods to which the formal violations refer through the F24 form, reporting the tax code "TF44" and with the indication in the box "anno di riferimento" the tax period to which the violation refers, in the format "AAAA". If the violations do not refer to a tax period, it is necessary to report the tax period in which formal violations were committed;

- for subjects with a tax period not coinciding with the calendar year, in the box " anno di riferimento", must be indicated the year of tax period ends in which the formal violations are regularized;

- the payment within 31.03.2023;

- the removal of irregularities or omissions until 31 March 2024 (which consists, for example, in carrying out the omitted fulfillment or correcting the un-correct fulfillment, or even re-sending the communication or submitting a supplementary declaration).

It is also specified that it is possible to use the compensation, in accordance with the Article 17 of Legislative Decree 9 July 1997, n. 241.

Filling in the F24 form

The years under assessment, for which it would be appropriate to carry out the regularisation of formal violations, are 2017-2018-2019-2020-2021-2022 (only until 31.10.2022).

It is not mandatory to regularize all the years, the taxpayers could decide to correct the formal violations relating to only one year.

Below is an example of the filling in of the F24 Form for each years under Tax Authorities assessment:

Year 2017

Year 2018

Year 2019

Year 2020

Year 2021

Year 2022

***